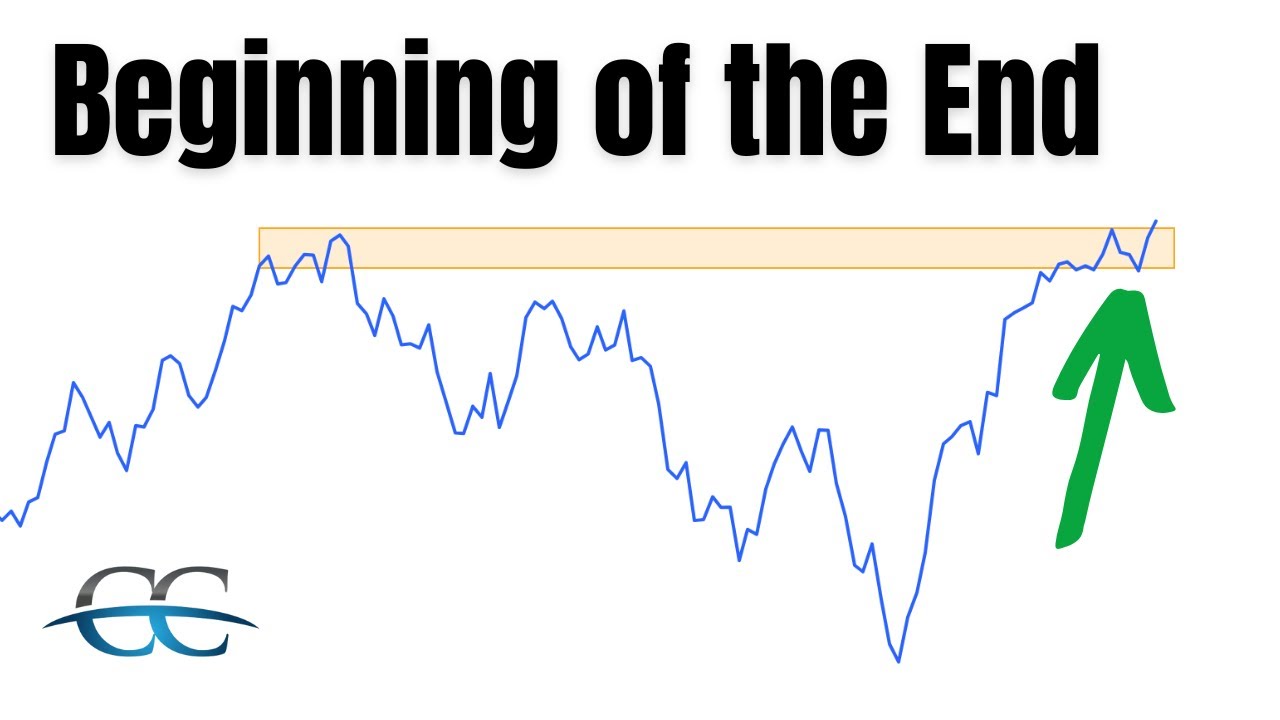

The S&P500 index $SPY broke out to new year to date highs today as I forecast last week. Stocks rallied to finish the week on the back of stronger than expected economic data with the Non-Farm Payrolls (NFP) report showing the US economy added 199,000 new jobs in November versus 180,000 that was forecast by economists. On top of that a consumer sentiment survey came up a lot higher than expected, fueled by lower inflation expectations thanks to sharp falls in the price of gas and mortgage rates. But how long will this Goldilocks scenario last and could we still get a surprise recession next year?

Join me today as I get you up to speed on all that’s happening across financial markets in stocks, bonds, commodities, currencies and more in the Click Capital Daily Markets Show.

📈 Get all my custom indicators for TradingView 👉 https://www.clickcapital.io/tradingview-indicators

🚀 Learn what MicroCap stock I just invested 12% of my long term portfolio into 👉 https://www.clickcapital.io/presentation

💸 Profit From Stocks Falling With My “ONLYBEARS” Strategy – Get the 1st Month FREE Using Coupon Code “UGVB79744” 👉 https://www.clickcapital.io/onlybears-strategy

🤑 Check out all the Trading & Investment Tools I Use 👉 https://www.clickcapital.io/trading-tools

#StockMarket #Stocks #OnlineTrading #NYSE #NASDAQ #TechnicalAnalysis #TechnicalIndicators #TradingView #StockCharts #SP500 $SPX $SPY $QQQ $VIX $TSLA $NVDA $AAPL $MSFT $AMZN

*Disclaimer: All of our content is not financial advice and should be considered as entertainment only. We are not licensed financial advisors. Trading stocks, ETFs, commodities, forex and other instruments comes with significant risk of loss of capital and isn’t suited for everybody. Please don’t copy our trades and always trade at your own risk.

source