SPACS have been a significant part of the cannabis landscape since the late 2017 IPO of Cannabis Strategies Acquisition Corp, now AYR Wellness. Twenty-three Cannabis SPAC IPOs have been completed for total proceeds of $4.24B. Of these, 5 SPACs with original IPO proceeds of $920M acquired non-cannabis businesses ranging from Wine to Space. Eight representing initial IPO proceeds of $1.72B, merged with cannabis-related companies, and 10 representing original IPO proceeds of $1.60B are still either looking for deals ($1.2B) or have transactions pending ($.4B).

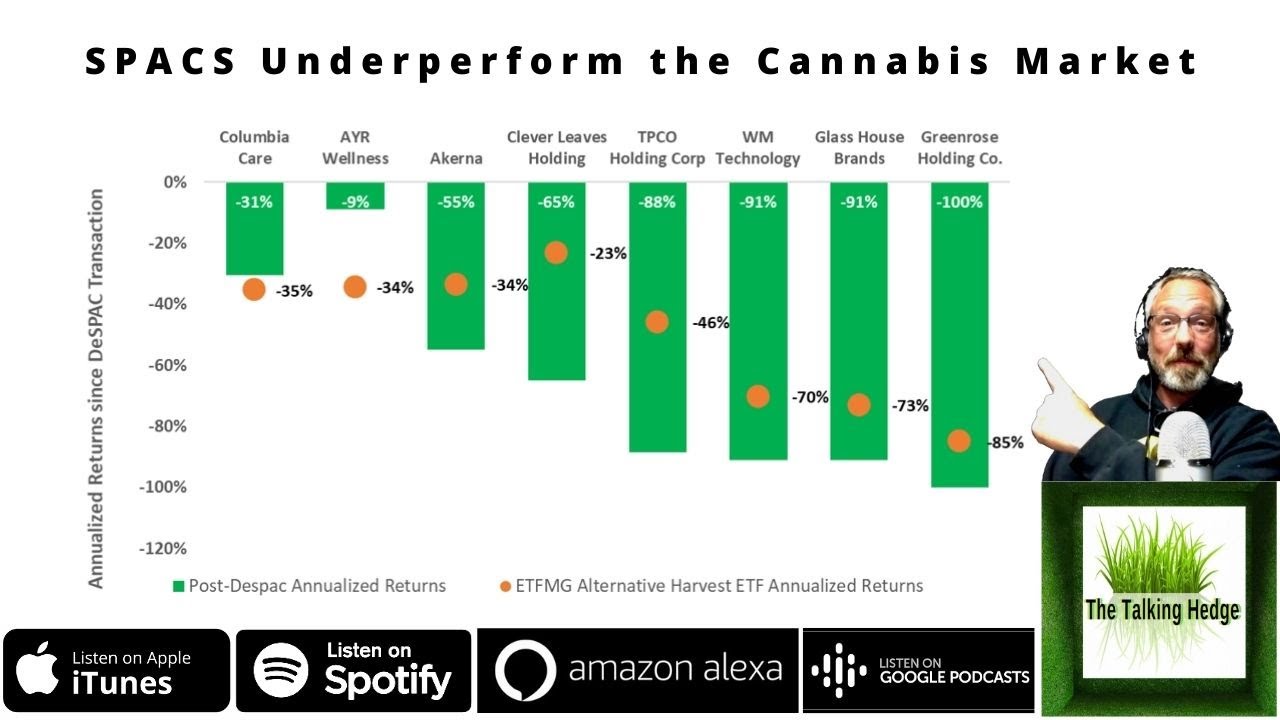

The graph is arranged in chronological order with the oldest de-SPAC deal on the left.

The green bars depict the annualized total returns of each company since its qualifying transaction, while the orange dot represents the annualized total return of the MJ Alternative Harvest ETF over the same period.

Given the downward draft of cannabis stocks over much of 2021, it isn’t surprising that all of the total returns are negative.

More surprising is that only two of the companies, Columbia Care (CSE: CCHW) and AYR Wellness (CSE: AYR.A), outperformed the broad cannabis ETF.

We see several broad themes in the performance of the group AYR Wellness (CSE: AYR.A) and Columbia Care (CSE: CCHW) have been rewarded for their aggressive acquisition programs in limited license states. AYR has outperformed the broader index by 25%, and Viridian Capital Advisors equity research considers it a top pick.

California competitors in the group have been harshly punished. In the 11 months since its de-SPAC transaction TPCO (OTC: GRAMF) is down 85.5% ( 88% annualized). Similarly, Glass House Brands (OTC: GLASF) in the less than six months since its de-SPAC is down 65.7% (73% annualized). Ironically, TPCO and GLASF were the two largest IPOs on the list at $575M and $402.5M, respectively.

Most importantly, the most recent SPACs have had a less receptive market to use their stocks as acquisition currency.

The group’s performance may help explain why the most recent SPAC IPO, Canna-Global had to use a whole warrant in its $230M IPO last week.

Show Notes:

SPACS Underperform the Cannabis Market

https://www.viridianca.com/chart3

Host:

Josh Kincaid, Capital Markets Analyst & host of your cannabis business podcast.

https://www.linkedin.com/in/joshkincaid/

Episode 867 The #TalkingHedge…

Your Cannabis Business Podcast.

Covering cannabis products, reviews, business news, interviews, investments, events, and more.

https://www.theTalkingHedgepodcast.com

Music Info:

Song: Music Keep On Beat | Artist: Milochromatic Beats

&

Song: Dark Trap Beats Hard Rap Instrumental | Gang | 2018Artist: LuxrayBeats

Keywords:

Hemp News, Weed News, Cannabis News, Marijuana News, Cannabis Business, Marijuana Business, Cannabis Industry News, Marijuana Industry News, Weed News 420, Talking Hedge Podcast, Cannabis Podcast, Marijuana Podcast, Business Podcast, CBD podcast, THC podcast, Cannabis Pitch Deck, Marijuana Pitch Deck, Marijuana Investment Deck, Cannabis Investment Deck, Cannabis Compliance, Cannabis Data, Cannabis Banking, Cannabis Investment, Pot Stocks, Cannabis Stocks, Weed Stocks, Marijuana Stocks, Cannabis Data, Marijuana Data, Cannabis Analytics, Marijuana Analytics, Cannabis Sales Data, Marijuana Sales Data

Josh is not an investment adviser. The Talking Hedge is long gold and silver. Listeners should always speak to their personal financial advisers. This is only entertainment.

source