As we approach the end of 2022 and say goodbye to a year in which the S&P 500 is on track for its biggest annual loss since the Great Financial Crisis, we are offered an opportunity to begin a new year with a fresh start. But with a challenging macro environment still at hand, market uncertainly remains an important consideration for investors.

Will the Fed’s aggressive rate policy send the market into a deep recession? Can inflation be curbed, and will the economy find stability to move forward? Where will new investment opportunities be found, and what developing trends will support these opportunities? These are just a few of the questions that need to be answered in 2023.

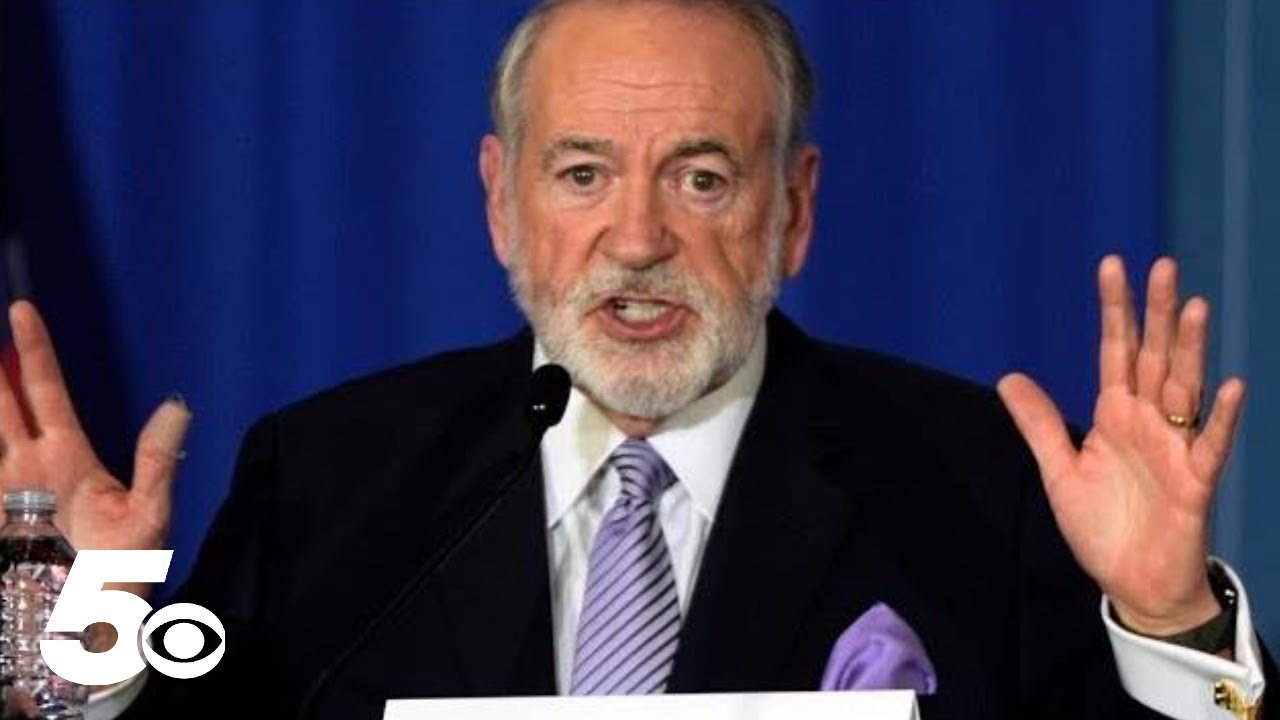

Join John Rowland, Barchart’s Senior Market Strategist, as he looks at our position in the economic cycle and the themes that may develop next year. John will use his forty years of experience to identify the stocks in the strongest position to respond to the changing market climate as well as the optimal combination of stocks and ETFs poised to capitalize on the developing 2023 market trends. The webinar will focus on capital preservation, limiting drawdowns, being defensive, and identifying the market’s next leaders.

At the end of this webinar, John will present his list of stocks and ETFs for 2023 which will be featured on Barchart’s website within the Investing Section.

In this webinar, you will learn about:

– Business Cycle Phases

– Sector Rotation

– Stocks and ETFs Poised to Capitalize on Developing Trends

– John Rowland’s list of Stocks and ETFs for 2023

#stockmarket #tradingtips #tradingmindset

source