Claim your Moomoo welcome rewards https://j.moomoo.com/01Iik6

Gate.io Crypto exchange, Web3, NFT, Defi

https://www.gate.io/ref/X1NDAVk?ref_type=102

OKX Crypto exchange and Wallet

Bridget, enjoy the crypto trading joiner together.

Enjoy the sharing ideas and earning

https://rumble.com/register/themarkets

Check out https://linktr.ee/thecapmarkets for complete coverage along with all the latest financial news and data!

—+++++++——-

Analyzing and strategizing around earnings releases requires careful consideration of both short-term trading opportunities and long-term investment potential. Here’s a breakdown of factors to consider and suggested strategies for the companies listed.

—

Key Analysis Factors

1. Volatility Around Earnings:

Stocks often exhibit increased volatility before and after earnings announcements. This can present opportunities for traders but carries higher risks.

Watch implied volatility (IV) levels for options trading.

2. Historical Earnings Performance:

Review past earnings reports to identify patterns (beats/misses).

Look for trends in revenue, margins, or guidance.

3. Industry Trends:

Macro trends in sectors like industrials, consumer goods, tech, and healthcare can amplify or dampen earnings results.

For instance, airline stocks (e.g., Delta Air Lines) are influenced by fuel costs and travel demand.

4. Forward Guidance:

Beyond reported earnings, listen to management’s guidance on future performance.

5. Market Sentiment:

Check analyst ratings and news sentiment around the stock.

—

Trading Strategies (Short-Term)

Pre-Earnings Trade:

Momentum Plays: Enter positions in stocks with high implied volatility (e.g., KB Home, Tilray) but strong bullish sentiment.

Use call options if bullish or put options if bearish to minimize capital risk.

Post-Earnings Trade:

Look for stocks with significant moves post-earnings that may revert due to overreaction (mean reversion).

Example: If Walgreens Boots Alliance misses earnings but drops sharply, it could offer a buying opportunity if fundamentals remain strong.

Straddle/Strangle Strategy:

For high-volatility stocks, consider a straddle or strangle option strategy to profit from large price swings, regardless of direction (e.g., Jefferies Financial Group, Delta Air Lines).

—

Investment Strategies (Long-Term)

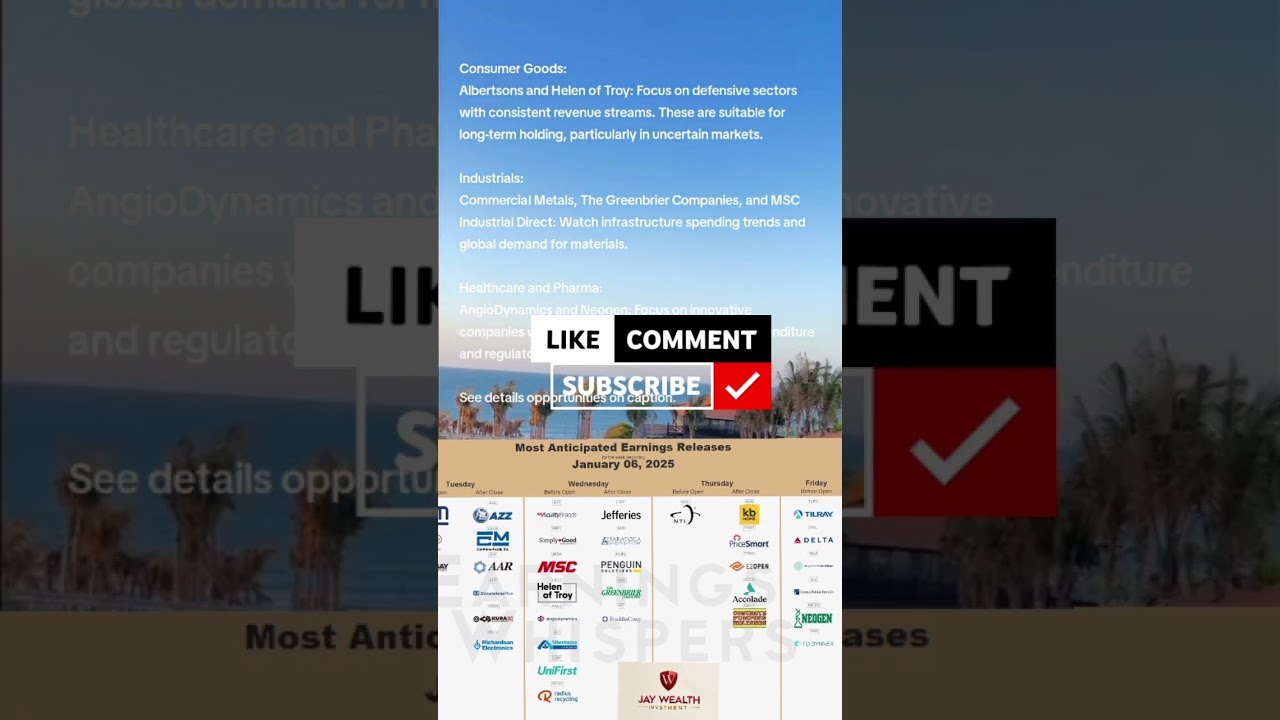

Consumer Goods:

Albertsons and Helen of Troy: Focus on defensive sectors with consistent revenue streams. These are suitable for long-term holding, particularly in uncertain markets.

Check for margin trends and competitive positioning.

Industrials:

Commercial Metals, The Greenbrier Companies, and MSC Industrial Direct: Watch infrastructure spending trends and global demand for materials.

These stocks benefit from economic growth but may face headwinds in recessionary environments.

Healthcare and Pharma:

AngioDynamics and Neogen: Focus on innovative companies with growth potential. Analyze R&D expenditure and regulatory developments.

Tech:

E2open, TD SYNNEX, and Accolade: Look for strong guidance and software/service adoption trends.

Invest in firms that have resilient business models (e.g., SaaS) and high margins.

Cyclicals:

Delta Air Lines: Consider the airline’s guidance on demand trends, oil prices, and operational efficiency.

Tilray: High-risk, high-reward play in the cannabis sector. Evaluate regulatory trends and growth in recreational markets.

—

Actionable Recommendations

1. Watchlist Creation:

Identify 3–5 companies that align with your risk tolerance and goals.

Example: High-growth investor -E2open, Defensive – Albertsons.

2. Pre-Earnings Analysis:

Read analyst previews and review last quarter’s earnings.

3. Risk Management:

Avoid over-leveraging in highly volatile stocks like Tilray.

Hedge your positions using options or ETFs.

4. Focus on Guidance:

Pay close attention to companies like Franklin Covey and Walgreens, where forward guidance could signal long-term prospects.

5. Post-Earnings Reaction:

Monitor the stocks for 1–2 days post-earnings to gauge market reaction. Consider adding to positions during dips on strong fundamental plays.

—

Example Strategy:

Stock: Delta Air Lines (DAL)

Short-Term: Play an options straddle for potential earnings volatility.

Long-Term: Invest if management indicates strong demand and cost management in 2025.

Stock: Constellation Brands (STZ)

Long-Term: Look for growth in premium alcoholic beverages.

source